Risk is the possibility that events will occur and affect the achievement of strategy and business objectives- COSO ERM Framework

Financial institutions confront a variety of trends that have introduced greater uncertainty than before, making risk management even more important. Each organization has a unique risk profile, influenced by factors such as industry, geography, and internal capabilities.For example, in the Philippines, natural disasters such as typhoons and earthquakes can disrupt business operations, while in Singapore and Malaysia, companies may face cybersecurity risks due to their position as technology hubs in the region.

To navigate these challenges successfully, companies must build resilience through a comprehensive risk management approach. Business continuity management (BCM) and enterprise risk management (ERM) are two critical components of a company’s risk management strategy. In this blog post, we will explore the co-relation between ERM and BCM, the differences between them, and how they can be integrated to improve organizational resilience.

Defining Enterprise Risk Management and Business Continuity Management

Around 61% of organizations’ ERM programs are less than 5 years old (Deloitte Global Risk Management Survey). This indicates that many companies have recently recognized the need for a structured and comprehensive approach to risk management. Enterprise Risk Management (ERM) and Business Continuity Management (BCM) are two distinct but complementary approaches to risk management.

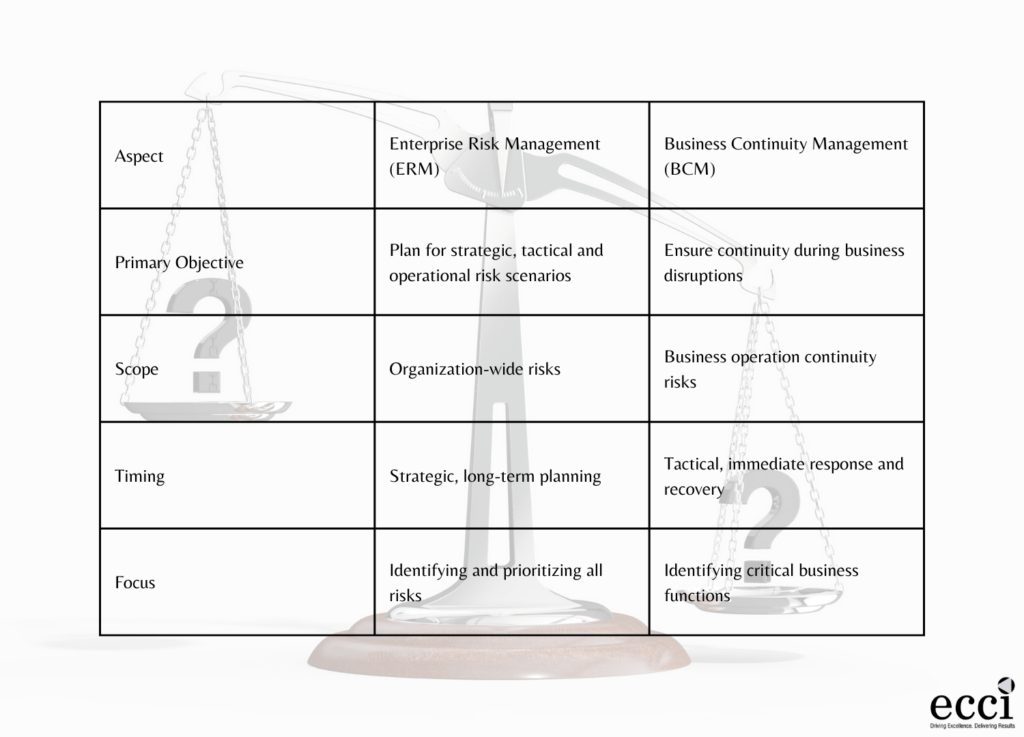

ERM is a strategic process that identifies, assesses, and prioritizes all potential risks across an organization. It encompasses risks related to finances, operations, regulations, reputation, and more. The primary objective of ERM is to proactively plan for hypothetical risk scenarios and develop strategies to mitigate or respond to them.

On the other hand, BCM focuses specifically on business continuity by identifying and mitigating risks that could disrupt critical business functions during an actual crisis or disaster.

So in essence, ERM is a broader discipline that integrates risk management into strategic planning efforts. BCM is a subset of ERM. BCM aims to ensure that essential operations continue functioning, allowing the organization to weather the storm and recover efficiently.

Integrating ERM and BCM can improve strategic alignment and coordination, enhancing an organization’s ability to prevent risks and achieve business resilience.

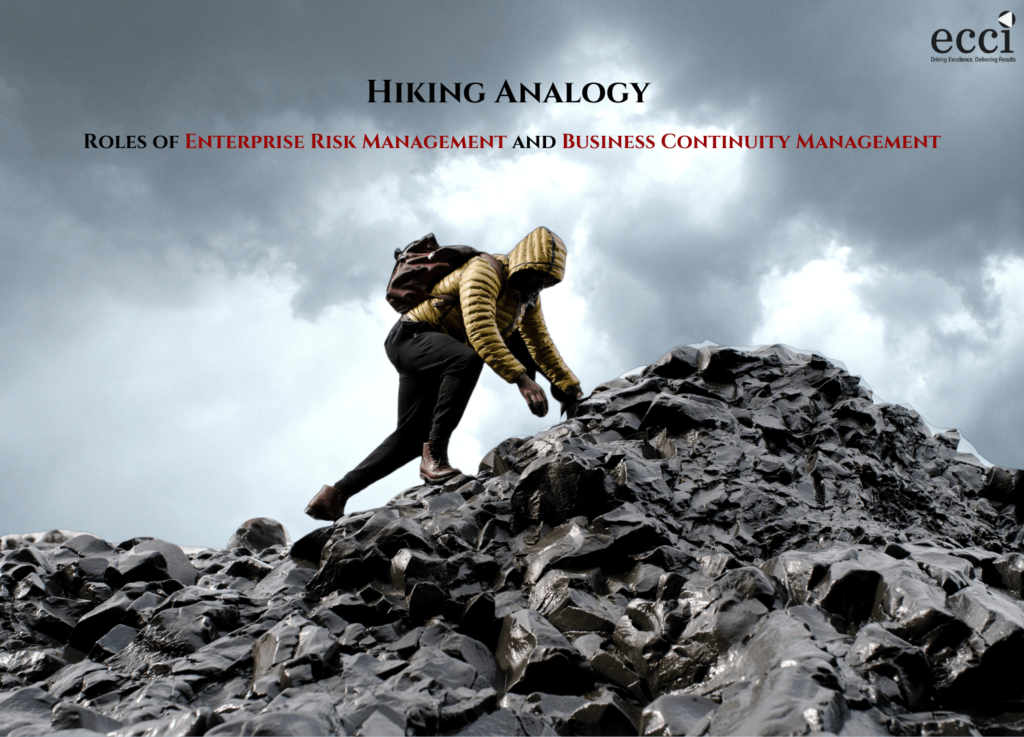

Hiking analogy to illustrate the roles of ERM and BCM

The basic difference between ERM and BCM is that ERM considers all the possible risks within the organization. On the other hand, BCM is in a way part of Enterprise Risk Management, which primarily looks at business operations and its continuity-related risks.

To illustrate this difference, let’s use a hiking analogy.

Imagine your organization as a group of hikers embarking on a challenging expedition. ERM serves as the experienced guide who anticipates potential dangers along the entire journey. The guide analyzes the terrain, weather conditions, and group dynamics. He prepares contingency plans for possible scenarios such as getting lost or encountering wildlife.

BCM, on the other hand, acts as the trailblazer within the group. When hikers face an unexpected obstacle, the trailblazer quickly takes action to find an alternative path. This will ensure that the group keeps moving forward and reaches their destination safely.

In the practical sense, ERM, focuses on identifying and managing all possible risks within the organization, while BCM is more tactical and primarily looks at business operations and its continuity-related risks. For example, in a financial institution or bank, ERM would focus on identifying and managing credit and market-related risks. On the other hand, BCM would focus on ensuring that critical business functions such as trading, settlements, and payments continue to function during a crisis or disaster.

The importance of both approaches in comprehensive risk management

The Association of College and University Auditors highlights that both ERM and BCM share the goal of identifying, assessing, and managing risks that could impact the achievement of strategic objectives

ERM and BCM are like two sides of the same coin. While ERM focuses on the strategic aspect of risk management and preparing for all types of strategic, tactical and operations risks, BCM deals with the tactical aspect of risk management, handling real-time disruptions.

By integrating these approaches, organizations can achieve comprehensive risk management, leading to enhanced resilience and improved decision-making.

Let’s quickly compare ERM and BCM in a table:

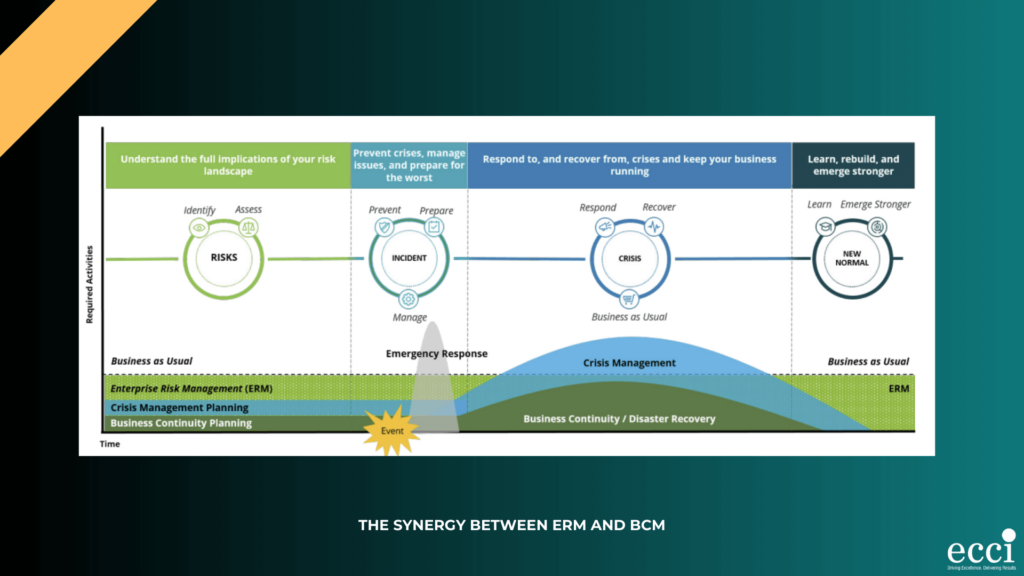

The synergy between ERM and BCM

ERM and BCM share common goals of identifying, assessing, and managing risks that could impact the achievement of strategic objectives. Both programs aim to minimize the frequency of disruptions and lessen the impact of disruptive events.

Both these programs are often governed by the same management team, sharing many of the same stakeholders. The ERM and BCM program owner can be the same individual, yet the programs can be managed separately.

ERM insights inform effective BCM strategies by assessing and addressing risks that could impact the achievement of strategic objectives. Integrating BCM as part of a comprehensive ERM program allows for a more comprehensive understanding of the universe of business risks faced by organizations. ERM and BCM integration improves strategic alignment and coordination, enabling organizations to prevent risks and respond effectively to disruptions. This integration enhances an organization’s ability to anticipate, respond to, and recover from potential disruptions, ensuring business continuity.

Image Content :

The impact on business operations and supply network

When it comes to addressing risks related to supply network disruptions, the integration of ERM and BCM becomes even more crucial. By leveraging ERM and BCM, organizations can proactively identify potential risks in their supply networks and develop strategies to mitigate them. This includes

Conduct a supplier risk assessment: This involves identifying and assessing the potential risks associated with working with a particular supplier. Supplier risk categories include financial risks, political risks, natural disasters, quality issues, delivery issues, and more.

Implement contingency plans like supply chain vulnerability assessment (SCVA) framework: This involves building a model for vulnerability factors that are internal to the supply chain and controllable. The SCVA framework enables professionals to take appropriate mitigation strategies to make the supply chains more robust.

Future-proof your supply chain sourcing strategy: Exploring alternatives for both suppliers and materials, dual-sourcing, and enhanced supplier relationships are critical steps in establishing alternative sourcing options. This approach enables organizations to identify potential risks and develop strategies to mitigate them.

Additionally, the integration of ERM and BCM helps protect product production capabilities. By identifying and managing risks that could impact production, organizations can ensure the continuity of their manufacturing processes, minimize disruptions, and maintain a steady supply of products to meet customer demand. Overall, the integration of both strategies plays a vital role in safeguarding business operations and supply networks, enabling organizations to navigate uncertainties and maintain resilience in the face of disruptions.

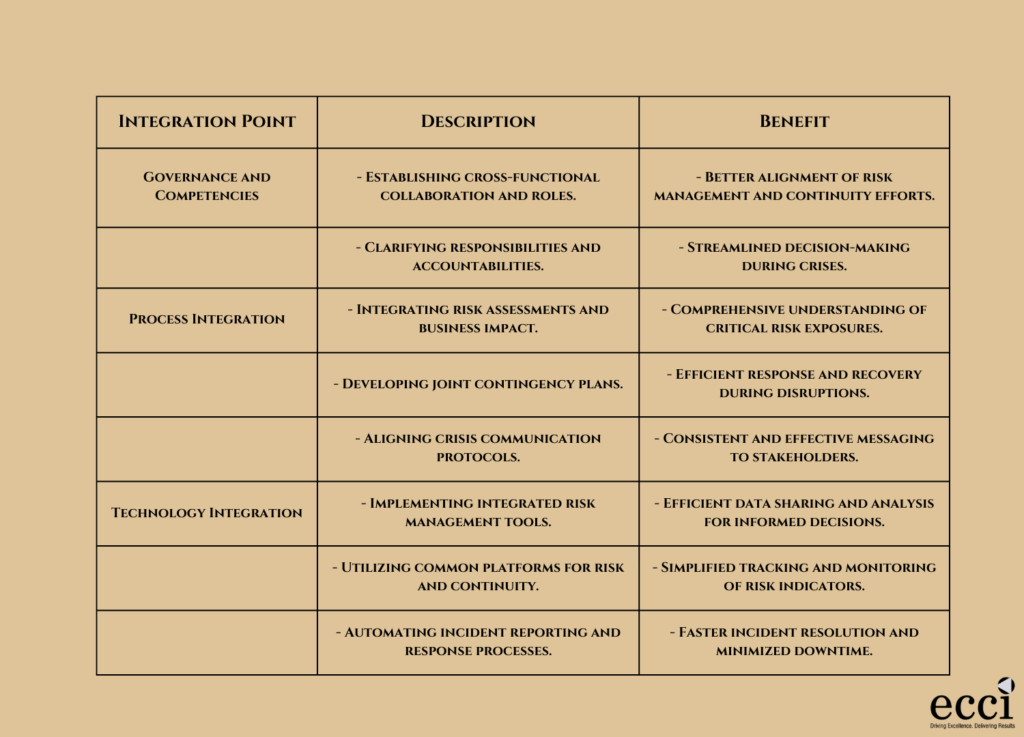

How to implement integrated ERM and BCM

Implementing integrated Enterprise Risk Management and Business Continuity Management is crucial for organizations to manage risks effectively and ensure business continuity. Here are some simple steps to implement ERM and BCM:

Identify the risks:

Conduct a risk assessment to identify potential risks that could impact the achievement of strategic objectives.

Integrate BCM as part of a comprehensive ERM program:

This allows for a more reasoned and less emotional understanding of the universe of business risks faced by the organization.

Link ERM findings with BCM:

To further strengthen the programs, consider linking ERM findings with BCM. This enables organizations to identify potential risks and develop strategies to mitigate them.

Establish a governance structure:

Establish a governance structure that outlines the roles and responsibilities of the ERM and BCM teams.

Define appropriate roles within the organization:

Even in environments where we want to break down the silos that have traditionally separated information sharing across these disciplines, it’s still important to understand how their functions are different. Defining appropriate roles ensures that the right people are responsible for the right tasks.

Train employees:

Train employees on the importance of ERM and BCM and how to identify and report potential risks.

Ensure leadership commitment:

Ensure that leadership is committed to the integration of ERM and BCM by allocating resources and support.

Communicate effectively:

Ensure that all stakeholders understand the importance of ERM and BCM and their roles in managing risks and ensuring business continuity through effective communication.

Apply a holistic, cross-discipline approach:

Business continuity management applies a holistic, cross-discipline approach across the organization. This is to minimize the frequency of disruptions and lessen the impact of disruptive events. This approach ensures that all departments and functions are involved in risk management efforts.

Monitor and evaluate:

Continuously monitor and evaluate the effectiveness of the ERM and BCM programs. This will ensure they are aligned with organizational goals and objectives.

Challenges against the successful implementation of integrated ERM and BCM

There are some common challenges that organizations face when implementing integrated ERM and BCM programs. These challenges highlight the importance of addressing organizational culture, communication, and coordination to successfully integrate and implement Enterprise Risk Management and Business Continuity Management programs. Overcoming these challenges requires strong leadership, effective communication, and a commitment to integrating complete risk management efforts across the organization.

Limited visibility into risks: Organizations may struggle to have a comprehensive understanding of all the risks they face across different departments and functions. This can hinder the effectiveness of risk management efforts.

Inconsistent risk management processes: Organizations may have inconsistent approaches to identifying, assessing, and managing risks. This can lead to gaps in risk coverage and hinder the integration of ERM and BCM programs.

Siloed risk management: Risk management functions may operate in silos, with limited collaboration and communication between different departments or business units. This can result in fragmented risk management efforts and hinder the integration of ERM and BCM.

Skeptical management or ambivalent board: Implementing ERM and BCM programs may face resistance from skeptical management or a board that is not fully supportive. This can make it challenging to gain the necessary resources and buy-in for successful implementation.

Articulating the integration of ERM and BCM: It can be challenging to clearly articulate how ERM and BCM fit together and the benefits of integrating these programs. This may lead to confusion among staff and resistance to change.

Real-life examples of successful implementation of ERM and BCM

JPMorgan Chase:

JPMorgan Chase has developed a practical methodology, the Carbon Compass, with the support of ERM, which tackles key challenges related to carbon emissions and sustainability.

By integrating ERM and BCM, JPMorgan Chase has aligned their risk management efforts to address risks related to carbon emissions and sustainability, enhancing their ability to identify and manage these risks.

Falken Tire Corp:

Falken Tire Corp. linked their ERM and BCM programs to develop a formal business continuity program.

By integrating ERM and BCM, Falken Tire Corp. has enhanced their ability to identify and manage risks, ensuring the continuity of their operations and protecting their value creation.

AT&T:

By integrating ERM and BCM, AT&T has improved their ability to manage risks related to their critical infrastructure and ensure the continuity of their services.

The integration enables AT&T to better protect and manage criticalities that can disrupt operations, including developing response, recovery, and restoration plans to minimize the frequency of disruptions and lessen their impact.

PwC:

PwC has developed an ERM-informed risk resiliency approach, which involves aligning the goals of both programs and involving BCM management in the ERM risk assessment process.

By integrating ERM and BCM, PwC can provide comprehensive risk management services to their clients, enhancing their ability to identify and manage risks and ensure business continuity.

Final thoughts

In today’s dynamic business environment, organizations face a wide range of risks that can disrupt their operations and impact their ability to deliver products and services. To address these risks, businesses need to adopt a comprehensive approach that integrates Enterprise Risk Management (ERM) and Business Continuity Management (BCM).

The symbiotic relationship between ERM and BCM is critical for enhancing organizational resilience. By aligning governance, sharing resources, involving management in risk assessment processes, and recognizing the value of integration in managing risks and ensuring business continuity, businesses can improve their ability to navigate potential disruptions.

Encouraging businesses to adopt an integrated approach to risk and continuity management is essential for long-term success. By developing a more comprehensive and holistic approach to risk management, businesses can identify and address risks that could disrupt their operations and impact their ability to deliver products and services.

For personalized guidance in strengthening your company’s resilience through ERM and BCM, reach out to us at ECCI. Our expert team specializes in bolstering organizational strength and promoting organizational resilience. We provide tailored strategies and practical solutions to identify and mitigate ESG risks, develop contingency plans, and enhance your organization’s overall resilience. Don’t wait for the next crisis to hit—take proactive steps now.

Contact ECCI Consulting today and let us guide you towards a more resilient future.

To start your journey, simply get in touch with us and enjoy a free advisory session. Visit our webpage for more information on how we can help you.