Earlier this September, the Securities and Exchange Commission (SEC) Philippines announced that it is revising the sustainability reporting guidelines to ensure consistency and uniformity in the sustainability measures reported by PLCs. Since then, organizations have been left to figure out how the upcoming changes could impact them and how best to prepare. This article sheds light on five key actions companies can prioritize now to prepare for the changes. Ready to learn more? Let’s dive in!

Five actions businesses should prioritize as they prepare for the upcoming changes in SEC’s sustainability reporting guidelines

i. Familiarize with standards and guidelines around climate change related risks and opportunities

One of the key changes in the SEC’s upcoming revised sustainability reporting guidelines is likely to be a heightened focus on climate change-related risks and opportunities. So, this means familiarizing yourselves with global standards and guidelines in this domain will be more important than ever. Apart from the widely known GRI standards, the Task Force on Climate-related Financial Disclosures (TCFD) also offers a framework for reporting on climate risks and opportunities, helping companies assess and disclose the potential impacts of climate change on their operations, strategies, and financial performance. Moreover, it’s essential to note that the SEC’s revised guidelines are expected to incorporate the IFRS S2 (Climate-related Disclosures) standard, which is another global standard that guides companies to comprehensively report on the risks and opportunities associated with climate change. Understanding these standards will be instrumental in aligning your reporting practices with emerging regulatory expectations and will also demonstrate your commitment to responsible corporate governance and sustainability.

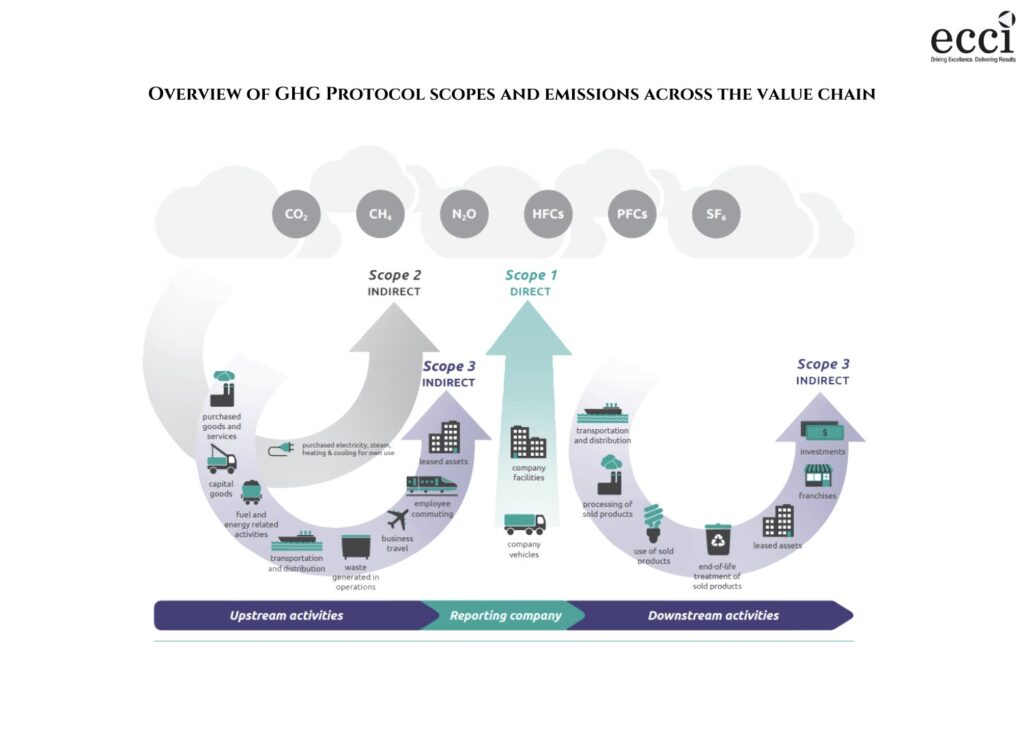

ii. Get comfortable with GHG footprint monitoring and understanding climate impact

As the revised SEC guidelines are expected to place more emphasis on climate-related reporting, companies should begin embracing the practice of monitoring their GHG emissions. This entails following the GHG Protocol, a widely recognized global standard for corporate accounting and reporting emissions. It categorizes a company’s emissions into three scopes: Scope 1 (direct emissions), Scope 2 (indirect emissions from purchased electricity, heat, and steam), and Scope 3 (other indirect emissions, such as those from the supply chain and business travel). Proactively monitoring and reporting on these emissions and understanding their climate impact will not only help your company align with regulatory requirements more effectively but also demonstrate your company’s efforts to measure, manage, and reduce its carbon footprint. This information is valuable to the stakeholders, including investors, customers, and the public, as it provides insight into your company’s environmental impact and commitment to addressing climate change. Furthermore, as the SEC guidelines evolve to align with international reporting standards, such as the IFRS S2, companies that are already well-versed in monitoring and assessing emissions across the three scopes will be better prepared to seamlessly adapt to these global standards.

iii. Start thinking about internal structure and governance around climate action and reporting

The third key action companies need to take is assessing their internal structure and governance. A well-defined governance structure serves as the backbone of an organization, ensuring accountability, transparency, and effective decision-making. It provides the essential guidelines and procedures for addressing critical issues that arise, whether they pertain to financial management, compliance, ethics, or strategic direction. The importance of this governance structure becomes even more pronounced when it comes to climate action and reporting. Having dedicated teams focused on climate-related disclosures will be pivotal for successful reporting in the evolving landscape. Businesses can start by appointing a sustainability or climate officer responsible for overseeing climate initiatives and compliance. Establishing clear lines of communication across departments is equally critical, ensuring that climate risks and opportunities are systematically factored into decision-making processes. By instituting this governance infrastructure early on, you will be well-prepared to navigate the upcoming SEC rules with confidence and agility.

iv. Prioritize streamlining data management systems

In today’s rapidly evolving landscape of sustainability reporting, data has emerged as the cornerstone of transparency and accountability. Thus, it’s crucial for companies to prioritize streamlining their data management systems. This entails establishing efficient processes for collecting, analyzing, and reporting sustainability data. A well-structured data management system helps in reducing the risk of errors and inconsistencies in your sustainability reporting. Ensuring data accuracy is crucial not only for regulatory compliance but also for building trust with stakeholders who rely on precise information. Streamlining your data management systems also empowers your organization to derive valuable insights from the data. This, in turn, informs strategic decision-making and helps identify opportunities for improvement in sustainability performance.

v. Step up sustainability reporting to include climate-related reporting irrespective of when the SEC changes become applicable

While the SEC’s specific changes may not be released yet, it’s wise for businesses to proactively step up their sustainability reporting efforts. They should start by recognizing climate-related aspects as critical to their organization’s sustainability. Climate change isn’t just an environmental concern; it’s a business imperative that affects performance, reputation, and resilience. Next, building internal capacity becomes essential. This entails developing the necessary resources, skills, and processes within an organization to effectively and accurately assess its environmental impact and progress related to climate goals. Then, companies should start measuring key climate metrics, such as GHG emissions, physical risks, transition risks, climate-related opportunities, etc. This way, businesses will be well prepared to start including climate-related reporting in their sustainability reports once the SEC changes are released, and they will also gain important insights that drive sound decision-making. Moreover, tracking climate performance is also good business as it helps organizations identify operational efficiencies, cost-saving opportunities, and potential risks. It positions them to make informed, sustainable choices that give them a competitive edge in a world increasingly concerned about environmental responsibility.

Conclusion

The SEC’s decision to revise the sustainability reporting guidelines for Philippine PLCs is a clear signal of the growing importance of sustainability and climate action in the corporate world. By prioritizing and implementing the steps discussed in this article, businesses can not only prepare for these changes but also embrace sustainability as a driving force for long-term success. Adapting to these evolving reporting requirements is not just a regulatory necessity; it’s an opportunity to thrive in an increasingly sustainable and responsible business environment.

As the landscape of sustainability reporting evolves, the need for expert guidance becomes increasingly vital. At ECCI, with our decade-long experience in assisting companies on their sustainability reporting journey, we are poised to support organizations in navigating the changes introduced by the SEC’s revised sustainability reporting guidelines.

Our range of services spans from crafting sustainability strategies and stakeholder engagement to materiality assessments and organization-wide awareness & elearning. We are committed to guiding you through every step, whether you are starting your sustainability reporting journey or seeking to enhance your existing practices. So what are you waiting for? Contact us today!

To start your journey, simply get in touch with us and enjoy a free advisory session. Visit our webpage for more information on how we can help you.